1. Introduction

From traditional stock investing to the innovative world of cryptocurrencies, each strategy is designed to address various risk profiles and investment timelines. I will also provide practical tips, real-life examples, and actionable insights so you can start implementing these strategies right away. If you want to explore more about crypto, don’t hesitate to check out Crypto Investing 101: A Beginner’s Guide for an in-depth understanding.

Before we dive into the specifics, remember that every investment decision should be tailored to your personal financial situation, goals, and risk tolerance. The strategies outlined here have worked for many, but it is essential to do your own research and consult with a financial advisor if needed.

2. The Importance of Financial Freedom

Financial freedom is not merely about accumulating wealth—it’s about having the flexibility to live your life on your terms. When you achieve financial freedom, you gain the independence to make choices that are aligned with your values and passions, without being bound by the constant pressure of financial constraints. In this article, I’ll explain how the right mix of investments can create a powerful engine for wealth creation. When applied consistently, these strategies can help you generate a passive income stream that may eventually cover your living expenses, allowing you to enjoy life, pursue your passions, and even retire early. By embracing our Top 10 Investment Strategies, you can build a solid financial foundation that supports both your short-term needs and long-term dreams.

In this article, I’ll explain how the right mix of investments can create a powerful engine for wealth creation. When applied consistently, these strategies can help you generate a passive income stream that may eventually cover your living expenses. This enables you to enjoy life, pursue your passions, and even retire early.

3. Overview of the Top 10 Investment Strategies

Here’s a brief overview of each of the ten strategies that I will elaborate on in the following sections.

3.1. Strategy #1: Diversification

Diversification is the cornerstone of any robust investment strategy. By spreading your investments across different asset classes—stocks, bonds, real estate, and alternative investments—you reduce your risk and create a balanced portfolio. This approach minimizes the impact of a downturn in any one sector.

3.2. Strategy #2: Long-Term Stock Investing

Investing in high-quality stocks and holding them over the long term is one of the most proven strategies to build wealth. This strategy involves selecting companies with strong fundamentals and a history of consistent performance. Over time, the growth in share value and reinvested dividends contributes significantly to your portfolio’s growth.

3.3. Strategy #3: Dividend Investing

Dividend investing focuses on companies that distribute a portion of their earnings to shareholders in the form of dividends. This strategy not only provides regular income but also offers the potential for capital appreciation. Reinvesting dividends can compound your returns over time and accelerate your path to financial freedom.

3.4. Strategy #4: Real Estate Investment

Real estate is a tangible asset that can generate steady rental income and appreciate in value over time. Whether you invest in residential or commercial properties, real estate provides diversification and acts as a hedge against inflation. For more insights on alternative investment opportunities, check out The Beginner’s Guide to Real Estate Investment.

3.5. Strategy #5: Index Fund Investing

Index funds offer a low-cost and diversified approach to investing in the stock market. By tracking market indices, these funds provide exposure to a broad segment of the market. This minimizes the risk associated with individual stocks and typically results in steady, long-term growth.

3.6. Strategy #6: Investing in Cryptocurrencies

Cryptocurrencies have emerged as a revolutionary asset class, offering high growth potential despite higher volatility. Whether you are interested in Bitcoin, Ethereum, or emerging altcoins, a strategic allocation to cryptocurrencies can yield substantial returns as the market matures. For those new to the crypto world, Crypto Investing 101: A Beginner’s Guide is an excellent starting point.

3.7. Strategy #7: High-Yield Bonds

High-yield bonds, often known as “junk bonds,” offer higher returns than investment-grade bonds in exchange for increased risk. They can be an attractive option for investors looking to boost income, but they require careful analysis and risk management before being added to your portfolio.

3.8. Strategy #8: Alternative Investments

Alternative investments include commodities, hedge funds, private equity, and even art. These assets are not directly correlated with traditional markets, providing a cushion during economic downturns. They diversify your portfolio and offer unique opportunities for growth.

3.9. Strategy #9: Robo-Advisors and Automated Investing

Robo-advisors simplify the investing process by using algorithms to manage your portfolio automatically. This provides a low-cost, efficient way to invest—especially for those who prefer a hands-off strategy. It is a great option for beginners or those who want to optimize their investments without constant oversight.

3.10. Strategy #10: Leveraging ETFs

Exchange-Traded Funds (ETFs) combine the benefits of index funds with the flexibility of trading like individual stocks. They offer a diversified investment approach while allowing for dynamic strategies such as sector rotation and tactical asset allocation. ETFs are ideal for investors seeking to balance risk with potential rewards.

4. Detailed Analysis and Examples

Now that we’ve introduced the top 10 strategies, let’s explore each one in detail with real-world examples, statistical data, and actionable tips.

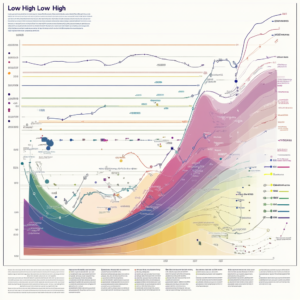

Diversification: The Foundation of a Robust Portfolio

Diversification is often described as the only “free lunch” in investing. By spreading your capital across various asset classes, you avoid putting all your eggs in one basket. For instance, during economic downturns, while stocks might decline, bonds and real estate may remain stable or even appreciate. One method to diversify is by investing in mutual funds or ETFs that cover a range of sectors and regions. A well-diversified portfolio typically includes equities, fixed-income securities, and alternative assets. This balance reduces overall volatility and provides smoother returns.

Example: Imagine an investor who allocates 40% of their portfolio to stocks, 30% to bonds, 20% to real estate, and 10% to alternative investments. Even if the stock market experiences a downturn, the impact is cushioned by the more stable performance of bonds and real estate.

Long-Term Stock Investing: Let Your Money Grow Over Time

Long-term stock investing is one of the most effective methods to build wealth. By purchasing shares of established companies with strong fundamentals, investors benefit from both capital appreciation and dividend reinvestment. The power of compounding should not be underestimated. A modest annual return compounded over decades can transform your initial investment into a significant nest egg.

Example: Consider investing $10,000 in a diversified stock portfolio with an average annual return of 7%. Over 30 years, your investment could potentially grow to over $76,000, assuming dividends are reinvested and market conditions remain relatively stable.

Dividend Investing: Earning While You Sleep

Dividend investing provides a dual benefit—income and growth. Companies that pay dividends tend to be well-established with steady cash flows. Reinvesting these dividends can lead to exponential growth in your portfolio over time. It is crucial to research companies with a history of dividend increases, as they tend to be more reliable and less affected by economic downturns.

Example: A portfolio of dividend-paying stocks yielding an average of 3% annually can create a significant income stream. Reinvesting dividends allows you to purchase additional shares, harnessing the power of compounding to build long-term wealth.

Real Estate Investment: Building Tangible Wealth

Investing in real estate is a time-tested method for generating wealth. Through rental income or property appreciation, real estate can serve as a significant component of a diversified portfolio. With careful selection and management, properties can yield consistent returns and act as a hedge against inflation.

Example: Owning a rental property in a growing urban area can provide both monthly cash flow and long-term appreciation. Moreover, real estate investments often offer tax benefits that further enhance overall returns. To learn more, consider reading The Beginner’s Guide to Real Estate Investment.

Index Fund Investing: Low-Cost, High-Reward

Index funds are designed to mirror the performance of a market index. They offer a low-cost way to invest in a broad market without the need to select individual stocks. This approach minimizes the risk associated with individual stock investments and typically results in steady, long-term growth. Many investors appreciate index funds for their simplicity and cost-effectiveness. They also perform well during periods of market stability, making them a foundational element of a diversified portfolio.

Investing in Cryptocurrencies: Embracing the Future

Cryptocurrencies represent one of the most dynamic asset classes in today’s financial markets. Despite inherent volatility, they offer the potential for significant returns as blockchain technology continues to reshape traditional financial systems. When investing in cryptocurrencies, it is crucial to allocate only a portion of your portfolio to this asset class. Diversification within the crypto market—by investing in both established cryptocurrencies and promising altcoins—can help manage risk. For beginners, a detailed introduction is available in Crypto Investing 101: A Beginner’s Guide.

High-Yield Bonds: Balancing Risk and Return

High-yield bonds offer the potential for higher returns than investment-grade bonds, albeit with increased risk. They can be a valuable addition to your portfolio if you’re looking to boost income. However, it is essential to perform rigorous credit analysis and risk assessment before investing heavily in these bonds. Weigh the risk of default against the possibility of enhanced income, and consider high-yield bonds as one component of a diversified strategy.

Alternative Investments: Expanding Your Horizons

Alternative investments include assets that do not fall into traditional categories such as stocks, bonds, or cash. This group encompasses commodities, hedge funds, private equity, and even art. While these investments can be riskier and less liquid, they offer valuable diversification, particularly when traditional markets are underperforming. By including alternative investments, you can reduce overall portfolio volatility and potentially enhance returns. It is crucial to thoroughly research any alternative investment and understand its unique risks and rewards.

Robo-Advisors and Automated Investing: The Future is Here

Robo-advisors have transformed the investment landscape by using algorithms to manage your portfolio automatically. This low-cost, efficient, and hands-off approach is ideal for investors who prefer not to micromanage their investments. Whether you are a beginner or simply want a more streamlined investment process, robo-advisors offer a compelling blend of simplicity and performance.

Leveraging ETFs: Flexibility and Efficiency

Exchange-Traded Funds (ETFs) combine the diversification benefits of index funds with the flexibility of trading like individual stocks. ETFs can be used for tactical asset allocation, sector rotation, and hedging against market volatility. They are an excellent tool for investors who desire a dynamic investment strategy without the complexities of active portfolio management. By incorporating ETFs into your plan, you gain cost-effective and versatile exposure to various markets and sectors.

5. How to Build a Diversified Investment Portfolio

Creating a diversified portfolio is essential for managing risk and maximizing returns. First, assess your financial situation by understanding your income, expenses, debt, and savings. This baseline helps determine how much you can invest without compromising your financial stability. Next, define your investment goals—whether you’re investing for retirement, a home purchase, or early financial freedom—as these goals will influence your asset allocation and risk tolerance.

A balanced portfolio might include 40-50% equities, 20-30% fixed-income instruments, 10-20% real estate, and a small portion (5-10%) allocated to alternative investments such as cryptocurrencies or high-yield bonds. Regularly rebalancing your portfolio, at least annually, is critical to maintaining your target asset allocation. Finally, monitor market trends and adjust your investments as needed to capture new opportunities or respond to changes in your personal circumstances. Internal Link Suggestion: For more insights into building a resilient portfolio, explore How to Build a Diversified Portfolio in 2025.

6. Tips for Managing Risk and Reward

Managing risk is as important as seeking returns. Educate yourself by staying informed about market trends, economic indicators, and new investment opportunities. Reliable sources such as government financial publications and academic research can provide valuable insights. For stock and crypto trading, consider using stop-loss orders to limit potential losses by automatically selling an asset when it reaches a predetermined price. Diversification across sectors—technology, healthcare, finance, and real estate—further minimizes exposure to any single downturn. Additionally, incorporating principles from our Top 10 Investment Strategies can enhance your approach to risk management.

If you’re interested in this market, I recommend a definitive course designed to equip you with the knowledge and skills you need to confidently dive into the world of cryptocurrencies and blockchain technology. As the digital landscape continues to evolve, this comprehensive course will serve as your compass, guiding you through the intricate paths of this exciting and transformative universe.

7. Frequently Asked Questions (FAQ)

Q1: What is financial freedom?

A: Financial freedom means having enough income and assets to support your lifestyle without being dependent on active work. It is achieved through smart investments, disciplined saving, and effective risk management. Many investors find that embracing the principles outlined in our Top 10 Investment Strategies helps them build a strong foundation for this freedom.

Q2: How important is diversification in investing?

A: Diversification is essential as it reduces overall risk by spreading your investments across various asset classes. This approach ensures that a downturn in one area does not significantly impact your entire portfolio. In fact, many of the key practices in our Top 10 Investment Strategies emphasize the importance of a diversified portfolio.

Q3: Are dividend stocks a reliable source of income?

A: Yes, dividend stocks provide a steady income stream, particularly when dividends are reinvested to compound returns. They are considered a more stable option for long-term wealth building.

Q4: How do I get started with investing in cryptocurrencies?

A: Start by allocating a small portion of your portfolio to cryptocurrencies, educate yourself on blockchain technology, and use reputable exchanges. For a comprehensive guide, refer to Crypto Investing 101: A Beginner’s Guide.

Q5: What role do ETFs play in a diversified portfolio?

A: ETFs offer broad market exposure with low costs and high flexibility, making them an excellent tool for diversifying your portfolio.

8. Conclusion

Achieving financial freedom is a journey that begins with informed decisions and strategic planning. The top 10 investment strategies discussed in this article provide a framework that, when executed consistently, can help you build wealth and secure your financial future. Whether it’s through diversification, steady growth from dividend investing, or the innovative potential of cryptocurrencies, each strategy plays a unique role in a well-rounded portfolio.

Implement these strategies, monitor your progress, and remain disciplined. For more detailed guidance and additional investment tips, explore our related articles such as Leveraging ETFs for a Stronger Portfolio and Smart Money Moves: Investment Tips for Millennials.

I truly hope that this comprehensive guide empowers you to make better investment decisions and paves your way to financial independence. Remember, investing is a marathon, not a sprint. Stay patient, keep learning, and adapt your strategies as the market evolves.